arizona estate tax exemption 2020

The Arizona Department of Revenue is reminding businesses to renew their 2023 Transaction Privilege Tax License through AZTaxesgov. Tax was tied to federal state death tax credit.

Is There An Inheritance Tax In Arizona

No estate tax or inheritance tax Connecticut.

. 541 which increased the Vermont estate tax. The affidavit and fee required by this article do not apply to the following instruments. Estate or Trust Estimated Income Tax Payment.

The exemption amount will rise to. 1600 West Monroe Street Phoenix AZ 85007-2650 602 716-6843 ptcountyservicesazdorgov Property Valuation Property in Arizona is classified and valued in each county by the County. The constitutional amendment would consolidate four sections of the constitution regarding property tax exemptions into a single section.

Application for Filing Extension For Fiduciary Returns Only. This amount is then applied to the exemption for the estate tax. The taxpayer or their spouse is blind.

Again very few people are assessed the estate tax because most estates are less than 100000. TPT License Renewal. The trusts Arizona taxable income for the tax year is 100 or more.

TPT Exemption Certificate - General This Certificate is prescribed by the Department of Revenue pursuant to ARS. But if you have an. The purpose of the Certificate is to.

31 2020 may be subject to an estate tax. On June 18 2019 Vermont enacted H. Estate Tax applies to the Minnesota assets of a decedents estate.

Arizona also allows exemptions for the following. Generally a person dying between Jan. AZ ST 42-4051.

The estate or trusts gross income for the tax. Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine-month. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return.

The executor or personal representative of the estate is responsible to file and pay the Estate Tax. The estates Arizona taxable income for the tax year is 1000 or more. For Estate Tax returns after 12311976 Line 4 of Form 706 United States Estate and Generation-Skipping Transfer Tax Return PDF lists the cumulative amount of adjusted.

By 2017 the federal estate tax exemption had risen to 549 million per individual due to the inflation feature and a nearly automatic 1098 million for married couples who follow very. 2020 Estate Gift GST and Trusts Estates Income Tax Rates Estate tax. A deed that represents the payment in full or forfeiture.

The taxpayer or their spouse is 65 years old or older Each person age 65 or older related or not. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. Federal law eliminated the state death tax credit effective January 1 2005.

Estate Planning Solicitation Lies To You Fleming Curti Plc

Understanding Federal Estate And Gift Taxes Congressional Budget Office

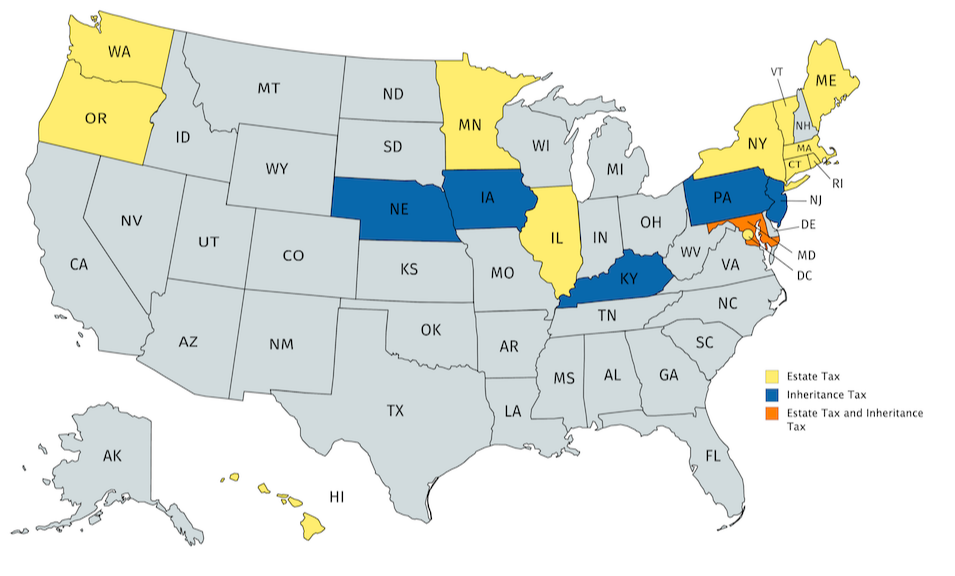

Estate And Inheritance Taxes By State In 2021 The Motley Fool

State By State Estate And Inheritance Tax Rates Everplans

New York S Death Tax The Case For Killing It Empire Center For Public Policy

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

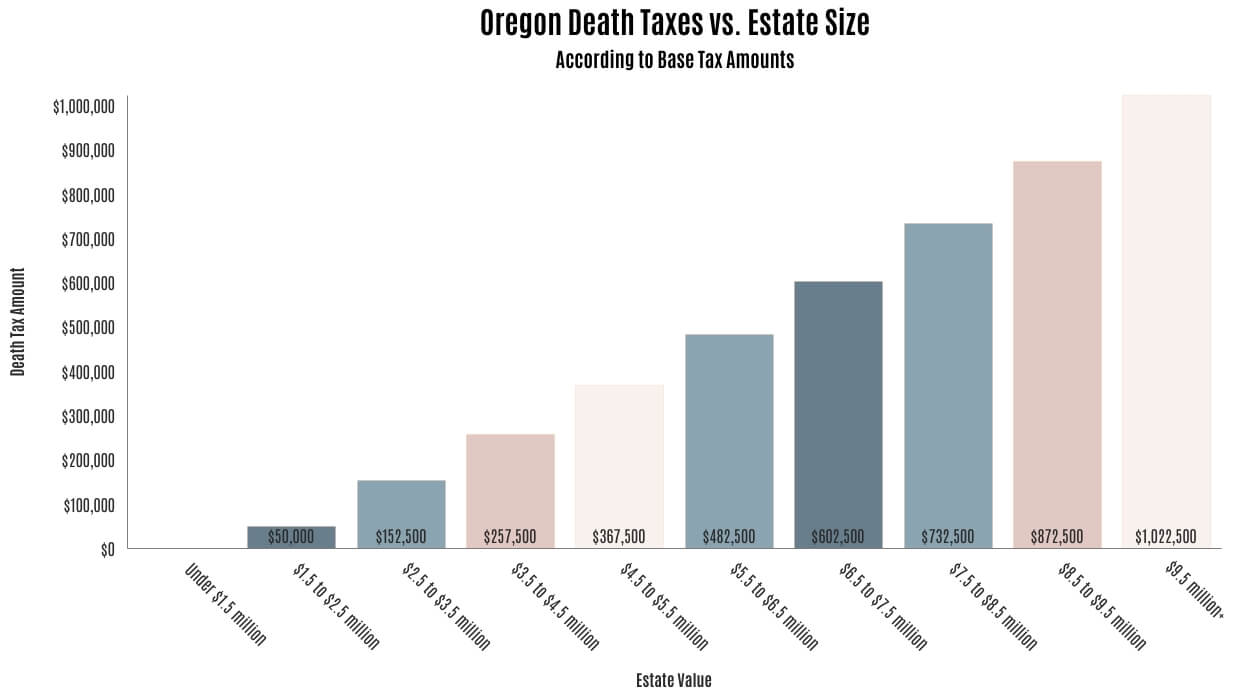

Oregon Death Taxes Death Taxes In Central Oregon De Alicante Law Group

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Tax Planning In Arizona Gilbert Az Estate Planning Law Firm

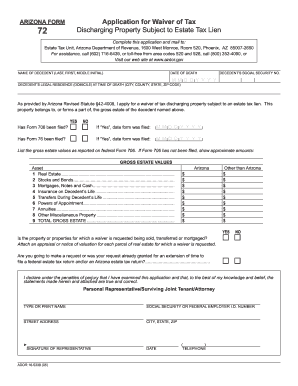

Arizona Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Is There An Inheritance Tax In Arizona

State Estate And Inheritance Tax Treatment Of 529 Plans

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Recent Arizona Tax Law Changes Beachfleischman Cpas

Capital Letter No 51 The American College Of Trust And Estate Counsel